Examine This Report about Bank Code

Wiki Article

Unknown Facts About Bank Definition

Table of ContentsThe 9-Minute Rule for Bank CodeThe Best Guide To BankThe Greatest Guide To Bank StatementTop Guidelines Of Bank ReconciliationThe Ultimate Guide To Bank Draft Meaning

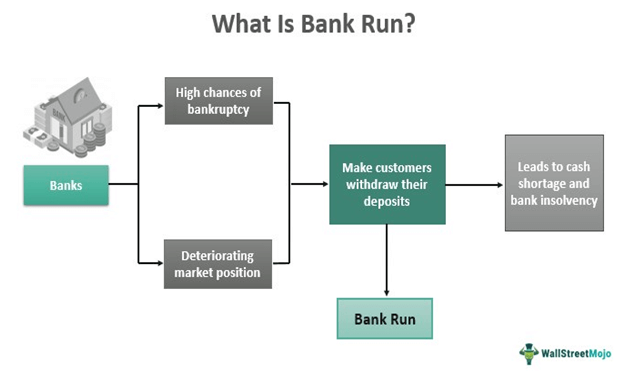

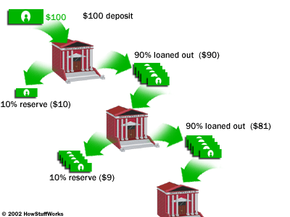

When a financial institution is perceivedrightly or wronglyto have issues, customers, fearing that they can lose their down payments, might withdraw their funds so quickly that the tiny portion of liquid assets a bank holds comes to be swiftly tired. Throughout such a "operate on deposits" a bank might have to offer other longer-term as well as less liquid possessions, frequently at a loss, to meet the withdrawal needs.

Regulators have broad powers to intervene in troubled banks to lessen interruptions. Laws are typically created to restrict banks' direct exposures to credit scores, market, and liquidity dangers as well as to total solvency danger (see "Securing the Whole" in this concern of F&D). Financial institutions are currently required to hold even more and also higher-quality equityfor instance, in the type of maintained revenues and paid-in capitalto buffer losses than they were before the monetary situation.

The Only Guide for Bank Statement

A bank is a monetary establishment authorized to offer solution alternatives for consumers that desire to conserve, borrow or accumulate even more money. Banks usually accept down payments from, and offer car loans to, their consumers. Can aid you get funds without a bank checking account.While banks may provide similar economic services as debt unions, financial institutions are for-profit services that direct most of their financial returns to their shareholders. That implies that they are much less likely to supply you the best feasible terms on a financing or a cost savings account.

Those borrowers then pay the finance back to the financial institution, with rate of interest, over a fixed time (bank). As the consumers settle their financings, the bank pays a portion of the paid passion to its account owners for permitting it to make use of the deposited money for provided car loans. To even more your individual as well as business rate of interests, banks give a big range of economic services, each with its own positives as well as negatives depending upon what your money motivations are and how they could advance.

The smart Trick of Bank Certificate That Nobody is Discussing

Financial institutions are not one-size-fits-all operations. Various types of customers will certainly locate that some financial institutions are better financial partners for their goals as well as demands than others.The Federal Reserve controls various other banks based in the U.S., although it is not the only government company that does so. Area financial institutions have fewer possessions because they are unconnected to a significant copyright, however they use financial services across a smaller sized geographic impact, like a county or region.

On-line banks do not have physical areas however tend to give far better rate of interest on car loans or accounts than banks with physical areas. Deals with these online-only institutions typically take place over a website or mobile app as well as thus are best for someone who does not call for in-person aid and also fits with doing a lot of their banking see this page electronically.

Some Known Questions About Bank Statement.

Unless you plan to stash your cash money under your bed mattress, you will ultimately need to communicate with a financial establishment that can safeguard your cash or issue you a funding. While a financial institution may not be the institution you at some point pick for your economic demands, understanding exactly how they operate and the solutions they can offer can aid you choose what to look for when making your option.Bigger banks will likely have a bevy of brick-and-mortar branches as well as ATMs in practical places, as well as various digital banking offerings. What's the distinction between a bank charges bank and also a lending institution? Because financial institutions are for-profit institutions, they have a tendency to provide much less eye-catching terms for their customers than a lending institution may provide to take full advantage of returns for their capitalists.

a lengthy raised mass, esp of earth; mound; ridgea slope, as of a hillthe sloping side of any kind of hollow in the ground, esp when bordering a riverthe left bank of a river is on a viewer's left looking downstream a raised area, rising to near the surface area, of the bed of a sea, lake, or river (in combination) sandbank; mudbank the area around the mouth of the shaft of a mine the face of a body of orethe side inclination of an airplane about its longitudinal axis during a turn, Additionally called: financial, camber, cant, superelevation a bend on a road or on a railway, athletics, biking, or other track having the outside developed higher than the within in order to decrease the results of centrifugal pressure on lorries, joggers, etc, rounding it at speed and also in some situations to promote drainagethe cushion of a billiard table. bank account number.

The Facts About Banking Uncovered

You'll need to give a financial institution navigate to these guys statement when you apply for a finance, documents tax obligations, or documents for divorce. A bank statement is a file that summarizes your account activity over a certain duration of time.

Report this wiki page